Everything about Merchant Account

Table of ContentsSome Ideas on Merchant Account You Need To KnowWhat Does Payment Processor Do?An Unbiased View of Card ProcessingHow Payment Processor can Save You Time, Stress, and Money.The 4-Minute Rule for Payment CheckupSome Known Factual Statements About Merchant Account How Online Payment Systems can Save You Time, Stress, and Money.

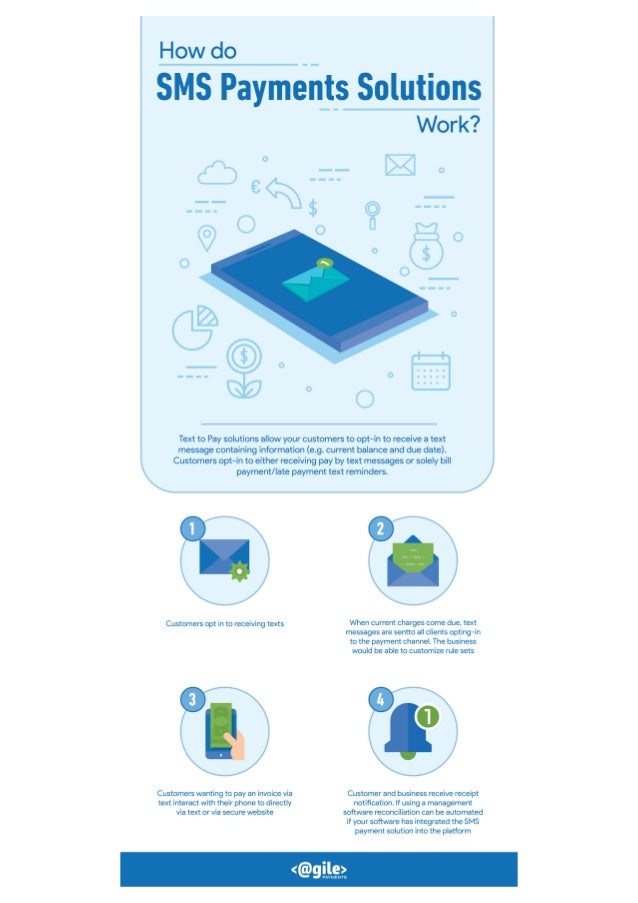

Deal condition is gone back to the payment gateway, then passed to the web site. A consumer obtains a message with the transaction condition (accepted or rejected) by means of a settlement system user interface. Within a number of days (generally the next day), the funds are transferred to the merchant's account. The deal is executed by the providing bank to the acquiring financial institution.

Now we are relocating closer to settlement portals in their selection. Repayment entrance combination Generally, there are four main approaches to incorporate a settlement entrance.

Some Known Incorrect Statements About Payment Checkup

What is PCI DSS compliance and when do you need it? In instance you simply require a payment entrance service and also don't plan to store or procedure bank card information, you may miss this area, because all the processing and also regulatory problem will be executed by your entrance or payment company.

This safety criterion was developed in 2004 by the 4 biggest card associations: Visa, Master, Card, American Express, as well as Discover. There are four levels of conformity that are identified by the number of safe deals your service has actually ended up.

SAQ is a collection of demands as well as sub-requirements. The most up to date version has 12 needs. AOC is a sort of test you take after checking out the requirements. There are 9 sorts of AOC for different companies. The one needed for sellers is called AOC SAQ D Merchants. The list of ASVs can be located below.

The 10-Minute Rule for Payment Checkup

Provided this details, we're going to look at the existing combination alternatives and describe the benefits and drawbacks of each. We'll also focus on whether you need to abide by PCI DSS in each case as we discuss what assimilation methods fit different kinds of companies. Held portal An organized payment entrance serves as a 3rd event.

Essentially, that holds true when a customer is rerouted to a settlement entrance website to enter their bank card number. When the transaction information is sent, the consumer is rerouted back to the seller's web page. Right here they settle the check out where transaction approval is revealed. Hosted repayment gateway work scheme of a hosted settlement entrance are that all payment handling is taken by the solution carrier.

Utilizing a hosted portal requires no PCI conformity and also provides quite simple assimilation. Customers may not rely on third-party settlement systems.

Examine This Report on Ecommerce

Basically, it's a piece of HTML code that applies a Pay, Friend button on your checkout page.

Direct Blog post technique Straight Message is an integration approach that enables a customer to store without leaving your internet site, as you do not have to get PCI conformity. Direct Article thinks that the deal's data will be published to the payment entrance after a consumer clicks a "purchase" button. The data instantaneously gets to the entrance and also processor without being kept on your very own server - payment checkup.

Some Of Merchant Account

Research study the pricing Repayment handling is intricate, as it includes a number of economic institutions or organizations. Like any type of solution, a payment entrance calls for a fee for utilizing third-party tools to procedure as well as license the deal.

Every settlement solution provider has its own terms of usage as well as costs. Typically, you will certainly have the complying with fee kinds: portal setup fee, monthly gateway fee, vendor account configuration, as well as a cost for each and every transaction processed. Read all the rates documentation to prevent surprise costs or added expenses. Inspect purchase limits for a provided provider While fees and also wikipedia reference installment charges are unavoidable, there is one point that may establish whether you can deal with a specific carrier.

Payment Processor Fundamentals Explained

This is basically a prebuilt entrance that can be customized as well as branded as your very own. Here are some widely known white label remedies designed for vendors: An incorporated entrance can be a dedicated resource of revenue, as vendors that get all the required compliance come to be repayment provider themselves. This suggests your business can process repayments for various other merchants for a charge.

are that you have complete control over the transactions at your web site. You can tailor your payment system as you want, and also customize it to your company requirements. In case of a white-label remedy, the settlement gateway is your top quality modern technology. generally are all concerning keeping the infrastructure of your settlement system and the related expenses.

Here are some things to take into consideration before choosing a supplier. Research the prices Repayment handling is intricate, as it consists of a number of monetary establishments or great site organizations. Like any solution, a repayment gateway needs a cost for using third-party tools to procedure and also accredit the transaction. Every celebration that participates in settlement verification/authorization or handling fees costs.

The 5-Minute Rule for Online Payment Systems

Every payment option company has its very own regards to usage as well as costs. Generally, you will have the complying with fee kinds: portal setup fee, monthly entrance fee, vendor account setup, and a charge for every deal refined. Review all the pricing paperwork to prevent hidden charges or added expenses. Examine why not try these out deal limits for a given service provider While fees and installation charges are unavoidable, there is something that may figure out whether you can deal with a specific supplier.